The International Racehorse Owners Network (IRON) has a vision: to revitalize the “sport of kings” and democratize it with the help of blockchain technology. If IRON has its way, the general public will no longer be mere spectators at horse races in the future. Above all, the younger generation, including in America, England and around the world, should be able to own shares in thoroughbreds in the form of racehorse tokens – and secure the next generation for the industry.

The sport of galloping has an attractiveness problem

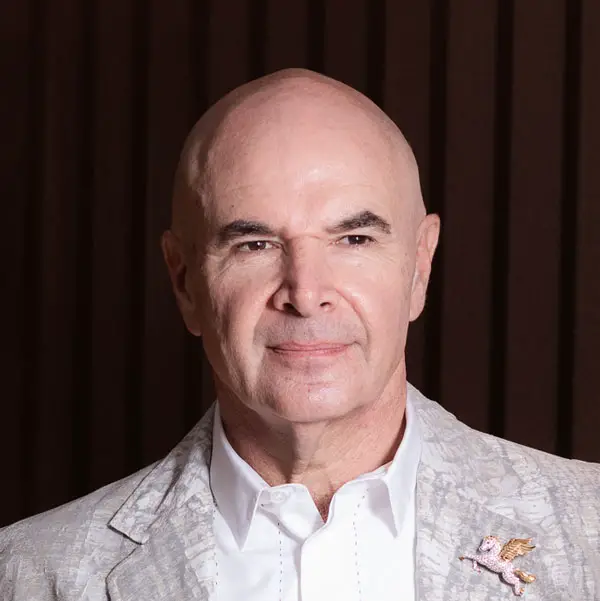

That’s because the industry has an increasing attractiveness problem among younger people. Frank Tong is managing director of QBN Capital and one of 33 “stewards” who run IRON as administrators. He says, “There is a tremendous amount of entertainment available today. In football, there are sometimes several events a week. Horse racing can’t compete with that.” In addition, he says, the barriers to entry for fans of galloping are high. If you want to be part of it, you have to pay a lot of money. And racehorse owners need a permit to allow their horse to run.

Overcoming the hurdles with horse tokens

For young people, IRON is a ticket to the racetrack ecosystem: With us, they can take their first tentative steps as horse token owners – with controlled risk. And they gain exclusive experience that is withheld from the public,” says Frank Tong. In the process, they would be relieved of the day-to-day business and tedious paperwork that comes with owning a racehorse. Blockchain expert Andrea Bianconi also sees these advantages. For him, the security aspect also counts: “The blockchain is completely transparent. Data cannot be manipulated. With paper documentation, something can always get lost.”

Seven thoroughbreds are ready for horse tokens

In the spring, IRON purchased its first seven yearlings from Inglis, Australia’s leading auction company for Thoroughbreds: three stallions and four mares. Racehorse tokens for digital sale: There’s “Writrose,” for example, the fiery two-and-a-half-year-old mare. Or the young stallion “Russian Colt,” both from Muskoka Farm in Australia.They are currently being made ready for the racetrack at Muskoka Farm in Australia. Investors will soon be able to buy shares in the animals with horse tokens. The owner of the renowned training stable, David Boehm, is also Chairman of IRON. Training is crucial to the success of a racehorse, he explains. You can do a lot wrong. This often leads to an early career end. IRON works exclusively with experienced trainers such as Chris Waller, John Moore, Peter and Paul Snowden and Mark Newnham. They would support the animals in such a way that they can develop their potential sustainably.

For young people, IRON is a ticket to the racetrack ecosystem: they can take their first tentative steps as racehorse owners.

Frank Tong, Steward and Managing Partner at IRON

Horse racing is a high-risk game

IRON relies on renowned partners to fulfill its own ambitious claim: to create the gold standard in infrastructure. And it wants to win the trust of investors. After all, horse racing is a betting sport. A lot of money is at stake. Seriousness is crucial. “Our thoroughbreds are optimally selected and they are optimally promoted,” says David Boehm. “We invest our investors’ money well.” Nevertheless, he says, horse racing always remains a high-risk game. That is also Andrea Bianconi’s assessment: “Racehorses are wonderful creatures. But they are also exposed to a high risk of injury. That jeopardizes performance and economic value.” Racehorse tokens are therefore only suitable as an investment for investors with an affinity for risk, he said.

The first IRON-tokenized horse

Name of sire | Written Tycoon |

Mother’s name | Ballet Rose |

Sex | Mare |

Date of birth | 8.9.2019 |

Trainer | John George Moore |

Training stable | Musoska Farm |

Three scenarios for racehorse tokenization

In parallel with the training of horses in Australia, IRON lawyers in Hong Kong are working to produce racehorse tokens for digital sale. Basically, there are three scenarios for chopping up gallopers as assets into digital shares:

- By tokenizing individual horses

- Tokenization of all horses in a “package”

- Tokenization of IRON as a company

Indirect ownership of horses

Mapping ownership of a horse per se is easy in all scenarios, says Frank Tong. However, he says, option 3 was chosen. Here, the tokens do not represent proportional ownership of a horse, but a share in the IRON organization. The organization owns the horses and takes over the race management. Each investor would have the right to prize money corresponding to his token investment. Results and winnings can be tracked by token holders in the U.S. and U.K. in the form of transparent data on the IRON platform.

Tokens can also include rights

Things get complicated when it comes to the rights associated with a token. For example, the decision as to which races a horse runs could be tokenized. Each token would then correspond to one vote. However, the intended younger target group in particular is likely to lack the experience and expertise to meaningfully weigh alternative starting options against each other. The IRON Horse and Racing Committee will therefore take over the race management. Unlike investments in art and wine, owners of IRON racehorse tokens should also be able to experience the horses up close. At least from a certain share. “Investors who participate with a large amount of tokens also get more rights for their higher capital investment,” Tong says.

We’re primarily concerned with getting young people excited about the sport of galloping – and producing the next generation of owners.

David Boehm, IRON chairman and owner of Muskoka Farm training stable

Token presale until the end of the year

Either way, people are working full steam ahead on tokenization. A presale is planned for the fourth quarter. Here, the interested parties who are already on the waiting list should get their chance. IRON expects the tokens to sell out quickly. Shortly before the horses go into racing, the actual offering phase will start. “Investors are investing in a gold mine of unknown proportions. Before the horses have run the first time, we have the purchase price as a basis for our calculation.” That averaged 500,000 Australian dollars for each horse. “How the value develops afterwards, no one can say. That’s why we have to have the financing in place beforehand.”

Racehorse tokens: high risk despite default insurance

In addition to the purchase price, IRON also includes race management, training and maintenance of the horses in the financing amount – for an investment period of four to five years. On average, a horse consumes 50,000 Hong Kong dollars a month – that’s 5,000 euros. This includes insurance costs. IRON’s racehorses are doubly insured: with a life insurance policy and a “loss of use” insurance policy. This compensates for loss of profit if the horse has to take a break due to injury. But, says Frank Tong: “No insurance covers all eventualities. With animals, you never know what will happen. The risk remains high.”

Sales launch in Asia and Australia

Currently, IRON is focusing on Australia and Asia for funding. There is no active advertising. Buying the seven Thoroughbreds at the spring auction was publicity enough, he said. The waiting list of people interested in tokens is long, according to David Boehme. However, the company is in talks with large auction companies in Europe and the Middle East. It is assumed that investor inquiries will also come from these regions and, for example, America or England. Namely, when the cooperation with other, internationally known partners is official. “What we are doing with IRON is not the attempt of a few individuals to achieve something. It’s the collective effort of an entire industry fighting for its future. And that lies in the democratization of gallop racing – on the blockchain.”

Better opportunities through diversification

Horse investing is risky. Those who invest their money in classically in a single racehorse run the risk of losing everything if the animal fails. Tokenization, however, allows for risk diversification. With a token investment, you only lose your share. With multiple horses, the risk can be spread. In addition, with multiple horse token investments, the chance of having an above-average performer increases. IRON makes no promises of returns, however. "Not knowing when what profit is possible with which horse is part of the appeal of galloping," says IRON Chairman David Boehme. Some horses have brought their owners more than a hundred times their purchase price, he says. But, "We're primarily concerned with getting young people excited about the sport of galloping - and producing the next generation of owners."

FAQ – Frequently Asked Questions

Not yet. The company is currently driving the tokenization of seven thoroughbreds. The horse tokens are expected to go on presale by the end of the year. Interested parties can register for a waiting list on the IRON website.

What exactly IRON horse tokens contain has not yet been determined. In any case, the right to prize money in proportion to the share. Depending on the situation, a say in racing decisions and handling rights could be added if necessary.

Horse racing is a high-risk game. The animals can underperform. They can also become so injured that they can’t race. Failure insurance never completely covers the risk.